In recent times, investing in initial public offerings (IPOs) has gained significant popularity among investors due to the potential for high returns. One such company that has been in the limelight is Netweb Technologies, which recently went public. Understanding Netweb Technologies IPO share price trends can provide valuable insights for investors looking to capitalize on this opportunity.

What is Netweb Technologies?

Netweb Technologies is a leading global IT solutions provider that offers a wide range of services, including web development, e-commerce solutions, mobile app development, and digital marketing. The company has a strong track record of delivering innovative and high-quality services to clients across various industries.

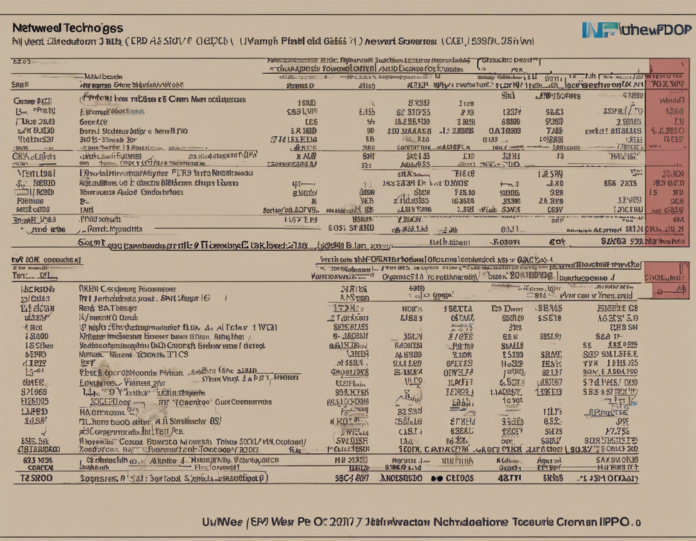

Netweb Technologies IPO Details

Netweb Technologies recently announced its IPO, offering a certain number of shares to the public for the first time. The IPO price is determined based on various factors such as the company’s financial performance, market conditions, and investor demand. Investors can purchase shares of Netweb Technologies during the IPO to become partial owners of the company.

Factors Influencing Netweb Technologies IPO Share Price Trends

Several factors can influence the IPO share price trends of Netweb Technologies:

-

Company Performance: Investors closely analyze the company’s financial performance, growth prospects, and competitive position in the market to determine the attractiveness of the IPO.

-

Market Conditions: The overall market conditions, including economic stability, industry trends, and investor sentiment, can impact the pricing of the IPO shares.

-

Demand and Supply Dynamics: The demand for Netweb Technologies’ IPO shares relative to the supply available can influence the share price trends. High demand can lead to an increase in share price.

-

Sector Performance: The performance of the IT sector, as well as the performance of other technology companies, can also affect the share price trends of Netweb Technologies.

Netweb Technologies IPO Share Price Trends Analysis

Analyzing the IPO share price trends of Netweb Technologies can provide valuable insights for investors. Here are some points to consider:

Historical Price Movement

Looking at the historical price movement of other technology companies that went public can provide a reference point for projecting the potential price trends of Netweb Technologies shares.

Investor Sentiment

Monitoring investor sentiment through social media, financial news, and analyst reports can help investors gauge the overall market perception of Netweb Technologies’ IPO.

Valuation Metrics

Assessing the valuation metrics such as price-to-earnings ratio, price-to-sales ratio, and other financial indicators can help investors determine whether Netweb Technologies’ shares are priced attractively.

Technical Analysis

Utilizing technical analysis tools to analyze price charts, support and resistance levels, and trading volumes can provide insights into potential price trends of Netweb Technologies shares.

Frequently Asked Questions (FAQs)

- What is an IPO?

-

An IPO, or initial public offering, is the first time a company offers its shares to the public on a stock exchange.

-

How is the IPO price determined?

-

The IPO price is typically determined based on the company’s financial performance, market conditions, and investor demand.

-

Can individual investors participate in an IPO?

-

Yes, individual investors can participate in an IPO by purchasing shares through their brokerage accounts.

-

Are IPOs considered risky investments?

-

Investing in IPOs can be risky due to the limited historical data available and the potential for high volatility in share prices.

-

How can investors research Netweb Technologies before its IPO?

-

Investors can research Netweb Technologies by analyzing its financial statements, growth prospects, competitive position, and industry trends.

-

When is the best time to invest in an IPO?

-

The best time to invest in an IPO depends on individual investment goals and risk tolerance. It is advisable to conduct thorough research before investing.

-

What should investors consider before investing in Netweb Technologies’ IPO?

-

Investors should consider factors such as the company’s financial performance, growth prospects, market conditions, and valuation metrics before investing in Netweb Technologies’ IPO.

-

Can IPO share prices fluctuate after the offering?

-

Yes, IPO share prices can fluctuate after the offering due to market dynamics, investor sentiment, and company performance.

-

What are the potential risks of investing in an IPO like Netweb Technologies?

-

Risks associated with investing in an IPO include market volatility, lack of historical data, regulatory risks, and company-specific risks.

-

How can investors mitigate risks when investing in IPOs?

- Investors can mitigate risks by diversifying their portfolio, conducting thorough research, setting realistic expectations, and consulting with financial advisors.

In conclusion, understanding Netweb Technologies IPO share price trends requires careful analysis of various factors that can influence the pricing of the shares. By staying informed, conducting thorough research, and understanding the market dynamics, investors can make well-informed decisions when considering investing in Netweb Technologies’ IPO.